Liverpool managing director Ian Ayre made headlines recently, making comments on the sale of English Premier League overseas TV rights which yanked him from behind the scenes into the spotlight.

Ayre quickly scrambled to recover his footing after other English clubs, including champions Manchester United, distanced themselves from his statements, in which he pointed to the overwhelming overseas support for the English Premier League’s biggest teams and asked “Is it right that the international rights are shared equally between all the clubs?”. The Liverpool chief even went as far as citing Bolton Wanderers as a side fans outside England would not be paying to watch.

The matter has been carefully handled at Anfield since, but Ayre’s foray into the public eye has stirred up a related debate on domestic TV deals that has proved divisive across Europe. When the continent’s best teams are all chasing Champions League glory, is it fair that deals for domestic TV rights are not always structured the same way? Should the English Premier League and Spain’s La Liga be singing from the same hymn sheet?

Inside Futbol looks at the arrangements within Europe’s leading leagues to shed more light on the current situation.

England

England

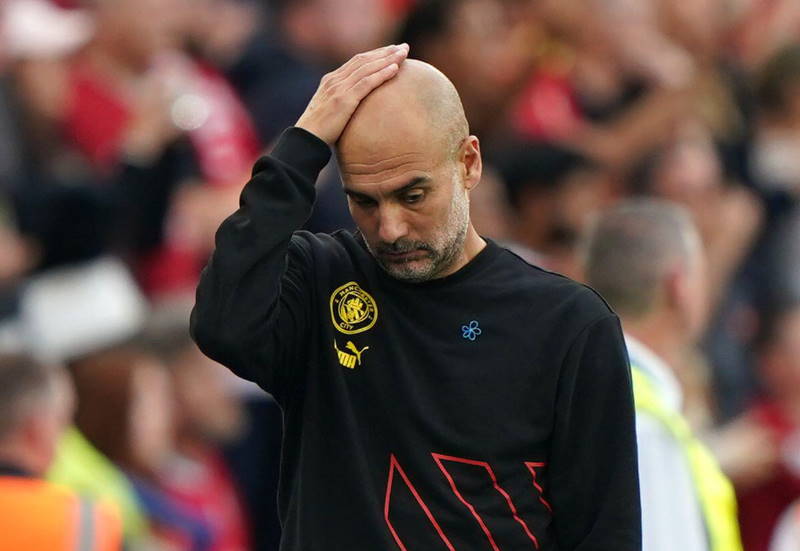

Premier League clubs sell TV rights on a collective basis, ensuring that the wealth is spread across the league. With the emergence of Chelsea and Manchester City as powerhouses to rival Manchester United, Arsenal and Liverpool, the league is more popular than ever and, through the current deal, the lucrative pot has risen above

£1.7 billion over four years.

A structured arrangement splits that total so that 50% of the money is equally divided amongst the 20 teams while the other half is handed out based on final league standings and the number of TV appearances scheduled. All in all, it puts the Premier League in pole position as the fairest divider of TV rights riches.

So while there is a huge gulf between Manchester United and the likes of Blackpool, going back to last year, or top flight new boys Swansea in terms of star power and bank balances, their shares of TV money will be far less dissimilar. As a result, a newly-promoted club, tasting the Premier League for the first time, can still pocket a cheque of more than £30M that will help cover the costs of chasing survival. The big boys have accepted this deal, too, with the top four all pocketing around £50M or more.

Taking in these facts, it is no coincidence that there is currently more parity than at any other time since the dawn of the Premier League era back in 1992. It is no exaggeration to say that beyond the top three, no final standings can be confidently predicted this season and such drama is keeping fans glued to the action.

Spain

Spain

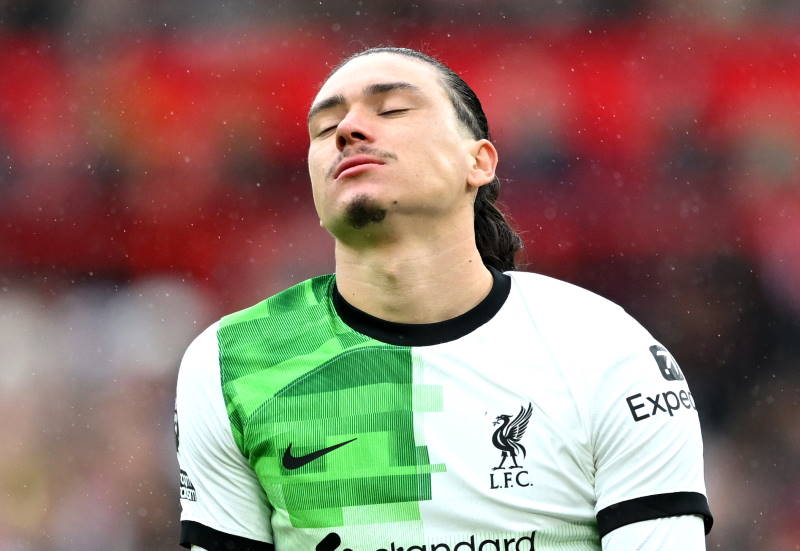

La Liga has gone in the opposite direction, allowing clubs to negotiate their own TV deals. While this approach offers teams independence to enter into their own negotiations, it also plays straight into the hands of established giants Barcelona and Real Madrid, aiding their dominance over the rest of the league.

While the two Spanish behemoths are believed to rake in sums in the region of £120M a year, the rest of the league survives in relative poverty. The next biggest earners are Valencia with close to £40M, followed by plucky Sevilla – then figures drop off further down the league table. Such a scheme benefits the big boys, but severely dents any chances of the rest of the pack making any inroads on the gulf that separates them from the upper reaches of the table. Last season, the clubs chasing Barcelona and Real Madrid were closer to the drop zone in terms of points than they were to finishing in second place – and that tells its own story.

However, Barcelona and Real Madrid have unquestionably prospered, giving La Liga world class representation in the Champions League. The extra income from TV deals just boosts the transfer kitty that has ensured the signings of stars such as Cesc Fabregas, David Villa, Cristiano Ronaldo and Mesut Ozil over the past few years.

But the problems start when lining up these numbers with other top European clubs, particularly Manchester United and Chelsea, the most successful English teams of the past five or six years. When comparing the sums generated by TV deals with the comparatively paltry split that Manchester United and Chelsea receive from the Premier League’s system, it is easy to see where the complaints over an uneven playing field come from. The Spanish giants can call upon squads packed with talent – but it also helps when cheques for TV rights are double those of rivals elsewhere in Europe.

Italy

Italy

While the most compelling stories come from England and Spain, Serie A also has real relevance in this debate. The Italians had a surprising change of heart last season, moving away from the system that had been in place since 1999 which allowed each team to make their own arrangements, a la La Liga, with a portion of revenue divided amongst other top flight teams. Instead, the Premier League model has been adopted, ensuring a split between the haves and the have nots of Italian football.

The news may not have gone down well with the likes of AC Milan and Inter Milan, who were raking in around £120M prior to the change, but the new system may revive a league that has lost some of its global appeal since the days of Paolo Maldini and Andriy Shevchenko. Aside from Inter’s outstanding run to Champions League glory in 2010, inspired by former boss Jose Mourinho, Italian sides have offered little resistance in Europe’s premier competition since 2007, with contenders from England and Spain taking control.

A more competitive league should drive increased attendances and a better quality of football week in, weeek out. In turn, that could mean more TV rights money in future to divide between the 20 top flight clubs.

Germany

Germany

In the Bundesliga, TV rights money, currently in the region of £850M, is split amongst the 18 clubs in Germany’s top flight. Unlike the Premier League, 50% is not divided among all teams. Instead, the breakdown is based exclusively on teams’ league finishes over the previous four years and the number of TV appearances each have made, rewarding success.

This arrangement allows for Bayern Munich, Borussia Dortmund and company to collect the lion’s share of the prize pot, aiding their bids to launch competitive Champions League campaigns. But it also ensures that the Bundesliga basement dwellers receive a welcome cash injection. These minnows might only get a cheque half the size of Bayern’s, but it is still an easier set-up than arranging their own negotiations.

France

France

Ligue 1 contributes a couple of clubs to the list of biggest TV rights earners, with the cash pool of more the £580M distributed between the league’s 20 teams, in part based on previous league positions. However, there have been rumblings of discontent at the actual terms of the split, with the likes of Lyon, Marseille, Bordeaux and Paris Saint-Germain reportedly preparing a push for a larger chunk of the money.

It is hardly surprising that lengthy negotiations are once again on the agenda, given the saga back in 2008 that finally led to the current arrangement. At that time, hopes had been high that the TV rights package would amount to far more than £580M, which was only a very slight increase on the previous deal. But, with Ligue 1 struggling to compete with the glamour of the Premier League and La Liga, such an offer was not forthcoming.

Clearly there are different arrangements in play across the major European leagues, with La Liga standing out in particular. As a result, some clubs find themselves with more lucrative TV rights income than others. But, realistically, there is unlikely to be a solution any time soon to bring all European leagues under a consistent format for negotiating TV rights and so, for now at least, any discontent must be shelved.

As Ayre found out over the past week, European football just is not ready to get caught up in TV rights debates.

Read more on the valid points Liverpool managing director Ian Ayre raised:

Liverpool Chief Right to Worry About La Liga TV Split